Is There a Storm Brewing For Bitcoin?

Being a 'disruptive technology' it makes sense that , one topic that comes up often within the Bitcoin community, is The Future of Bitcoin. We talk about how Bitcoin can help the current world, such as coming in as a big part in the future of Greece. We talk about the technology itself, should block sizes change? And we talk about the road to mass adoption. Today Entrepreneur published a post called 'what is the future of Bitcoin'

Here at The Finance Guy, we are no different, we have talked about the future of Bitcoin in the past, and we are going to do the same thing again now. We think that there is a storm brewing for Bitcoin. The market has been quiet, too quiet. It could be the prophetic 'quiet before the storm. We will look at:

How Bitcoin Looks in 2015

Bitcoin appears to be finding price stability in 2015, and is moving sideways, as shown below:

source: blockchain.info

As we can see, the USD price of Bitcoin is settling. The first three months to March saw Bitcoin drop from over USD $300, to a low of USD $177 in late January. It promptly recovered and the market has been quietening down since. Bitcoin has spent most of the last three months drifting comfortably between USD $225, and USD $250. The past 3 months are quite a contrast to the wild moves in market price Bitcoinners have become accustomed to.

We'd expect that a more stable price would be great for Bitcoin, but at we noted in a previous post, Bitcoin volume is decreasing in 2015. People are using Bitcoin less now than they did when the price was wildly volatile. This does not make sense to us. We thought a less volatile price would make Bitcoin more attractive to new adopters. This may be true, but the adoption rate is not enough to keep up with people who are decreasing their use

A Look at the Volatility of Bitcoin

Market volatility is commonly accepted as a measure of how risky an investment is. To find the volatility of any investment, we look at the recent price history and measure how much the price fluctuated. The higher the volatility, the more financial risk the investment has. Bitcoin currently has an estimated volatility of 1.55%. Back in January the volatility of Bitcoin was over 7%. A history of the estimated volatility of Bitcoin is shown below:

Source: The Bitcoin Volatility Index

As we can see, 2015 has seen a distinct drop in market volatility for Bitcoin. This supports our observation that the price has settled into a comfortable range. If we use volatility as an indicator as to how likely price is to fluctuate in the near future, then we'd expect that Bitcoin will continue sideways for a little while longer. Again, this should be good for Bitcoin and help attract new merchants and adopters.

Why we think there is a Storm Brewing

Falling volatility and stabilizing prices should be good news. It could be argued that Bitcoin is finding fair value and 2015 is foundation for a more stable future. We think that the market is taking a breather before getting back on the roller coaster. Our opinions are based on our belief that:

Bitcoin has volatile volatility - This is not the first time we've seen the Bitcoin market take a breather. Our chart shows that in late 2012 and early 2013, the volatility was in a similar place to where it is now. After which, it abruptly jumped to over 15%, we saw the price go on an insane rally from USD $200, to almost USD $1,200. Is it possible that we are in for a repeat performance?

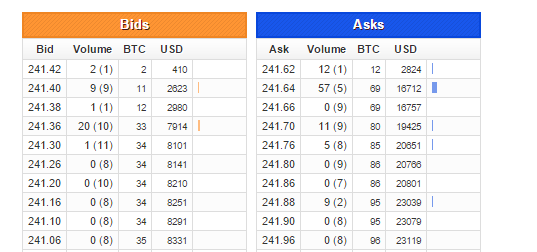

Falling USD Transaction Volume - If less people are trading Bitcoin, then there is less market depth. We believe this makes the price more vulnerable to fluctuations caused by unusual events or particularly large trades. The BTC market depth on Bitstamp is shown below:

Source: Bitcoincharts

In market depth, bids represent people who want to buy Bitcoin at a particular price. They will put in a 'limit order' to buy a set quantity at a set price. Once their bid is on the market, they will automatically buy Bitcoin if the price drops to meet their bid. They have agreed to buy a set quantity at a set price. The ask is where people trying to sell Bitcoin do the same thing in reverse. They agree to sell a quantity of Bitcoin if the market price increases to meet their ask. These are known as 'limit orders'

People who don't want to wait for the price to move up or down, will buy or sell their Bitcoin will place 'market orders'. If you wanted to buy 15 Bitcoins at market, using the above market depth, then you'd get the first 12 at a price of $241.62, and the next 3 at a price of $241.64. Your average buy price would've been $241.624

If you were to sell 15 Bitcoin at market, you'd get $241.42 for the first 2, $241.40 for the next 11, and 241.38 for the last 2. Giving you an average sale price of $241.40. There is a difference of 22.4 cents between buying and selling the same amount of Bitcoin at market. This difference is called the 'market spread'.

If there were larger amounts for sale at $241.42, then the seller would have gotten an extra 2 cents per bitcoin on their trade. It's only a difference of 30 cents, but it does show how even a trade of 15 Bitcoin can move the market. Now imagine if someone tried to sell 100 Bitcoin in a hurry at market. They'd clear out all the market bids down to a price of $241.26, and sell at an average price of $241.348. Someone buying 100 Bitcoin at market would move the ask price up to $241.66 and would buy at an average price of $241.61. The market spread for 100 Bitcoin is 29.3 cents

In 2014 it was not uncommon for the daily volume to be over 400,000 per day. Now there are around 200,000 Bitcoin traded per day. What would happen if something made the volume spike? Imagine if all of a sudden people rushed to quickly buy or sell Bitcoin. Given that just 100 Bitcoin can make the market move by 30 cents, what impact would a surge of 200,000 have?

Where do we think Bitcoin is heading

We believe that Bitcoin is ready to make a huge move, but we are not sure if this will be up or down. The market is waiting for a major event to either bring people into the market, or make them run for cover. No matter what happens, we will be watching with interest, and will hopefully have something to say about it here on TFG

What do you think the future holds for Bitcoin? What changes in the near future will make the market come to life and move the price? We'd love to hear your thoughts and feedback, so please feel free to share in the comments section below.