Our Australian Dollar Forecast: Tough Times Ahead

On July 20th 2015, the AUD/USD exchange rate hit a low of 0.7327, the lowest it has been in more than 6 years! We expect that this is only the beginning of what will be a prolonged down turn for the Australian Dollar. It's not just the currency that is in for a rough ride. The Australian Economy could be heading for a recession!

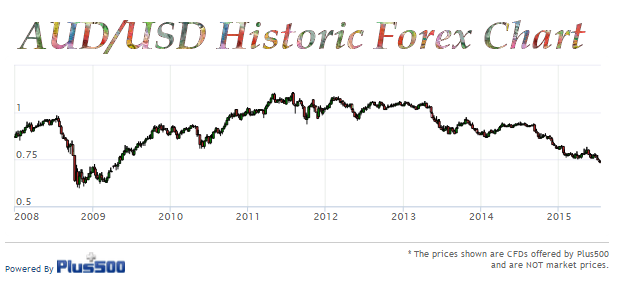

If we look at a recent history of the Australian Dollar / US Dollar exchange rate, we can see that the AUD has fallen to levels not seen since 2009. Economic conditions suggest that the AUD could continue to fall well into the 60s

AUD/USD chart created with our live AUD/USD Chart

Fundamentals Supporting the AUD are Changing

The Australian Dollar is a resource currency, and the economy is commodity-focused. The health of the Australian economy and the strength of the Australian Dollar have a strong correlation to resources such as gold, oil and coal. Resources do not move with the normal 7 year economic cycle. Resources move in a 20 year Super Cycle

We Are No Longer In a Mining Boom

Australia has enjoyed 23 consecutive years of economic growth. Even when the world was suffering the impact of the Global Financial Crises (GFC), Australia was enjoying economic good times. Thanks to strong demand for Australian resources, we side stepped the GFC, and experienced an improvement in our terms of trade. This helped the AUD climb above parity against the US Dollar

Australian exports were booming! This means that money was flowing into the country. This caused the value of the AUD to increase and stimulated economic growth throughout the economy. As the prices of resources start to ease, this will have a damaging impact on the AUD and Australian Economy

Historic Spot Price of Gold created with our live Gold Chart

China is Slowing

Australia's largest trading partner is China. Throughout the mining boom, they were our best customer. While data regarding the Chinese economy is difficult to validate, there is no hiding the fact that they are buying less raw materials from Australia. This is bad news for the mining sector. Deteriorating terms of trade with China, will have a knock on effect that will impact the entire economy.

AUD Foreign Exchange Rate

If China is buying less raw materials from us, then this causes a reduction in total Australian exports. This will cause the Australian Dollar to depreciate. Exports represent demand for a currency. China was buying raw materials from Australia, and paying in Australian Dollars. This stimulated the Australian Dollar in its epic rise beyond parity with the US Dollar. Our long term outlook for the Australian Dollar: We expect to see the AUD fall below USD 70.00 by the end of 2015.

Before the mining boom, Australia was often referred to as a 'small open economy'. We tended to import more than we exported, causing our Balance of Payments and Current Account to be in deficit. Our dollar had the nickname 'The Aussie Battler'.

The equilibrium value of the Australian Dollar has increased due to the mining boom. Now that the boom is over, we expect that the AUD equilibrium will revert to levels below 100. A history of the AUD TWI equilibrium is shown below:

As we can see, the Australian Dollar started rising in time with the resources boom. We believe that the success of the Australian mining sector, was the underlying reason for the rise in the AUD.

Further Reading

- Australia as a Small Open Economy - Reserve Bank of Australia

- The Australian Dollar: 30 Years of Floating - Reserve Bank of Australia

- Australian Dollar Hits 6 Year Low - Sky News

- Australian Dollar Tipped to Drop Below US60c - Sydney Morning Herald

- Australia Heading for Recession - ABC News

- Credit Suisse cuts local equities outlook - Australian Business Review

What are your thoughts on the AUD and the outlook for the economy? We'd love to hear from you in the comments section below.