Australian Mortgage Industry in for Big Changes

Buying an investment property in Australia, has suddenly become more difficult. Several lenders have adjusted their policies toward residential investment mortgages, and all the changes have made it more difficult for borrowers. The banks are reacting to changes announced by the Council of Financial Regulators, which is made up of ASIC (Australian Securities and Investment Comission) RBA (Reserve Bank of Australia), and APRA (Australian Prudential and Regulatory Authority).

On December 9th 2014, the Council of Financial Regulators declared their intention to take steps to 'reinforce sound residential mortgage lending practices'. On July 20th 2015, the first change was made and the banks have reacted.

We expect that this is only the first of many changes to come for the Australian mortgage industry. On July 20th, APRA increased the capital adequacy requirements for residential mortgage providers which use the Internal ratings-based (IRB) system of credit risk. The changes were only expected to impact ANZ, CBA, NAB, Westpac and Macquarie, but we've seen reactions from all over the industry including:

- ANZ- Have increased the standard variable rate they charge on residential investment property by 0.27% to 5.65%. This will impact all existing and investment borrowers.

- CBA - Followed suit and increased interest rates for investment property by 0.27%. This will impact all existing and investment borrowers.

- NAB- Has increased interest only rates by 0.29%. This will apply to all interest only home loans, not just investors.

- Westpac - Has increased the minimum deposit needed for investment loans to 20%. They have also announced that new investment loans will not be entitled to special pricing.

- St.George - Have increased the minimum deposit needed for investment mortgages to 20%. So far they have not made any change to interest rates. This will only impact new applicants

- Macquarie Bank - Have increased variable and fixed investment rates by 0.27%. New fixed rates apply only to new loans, new variable rates apply to all existing variable investment loans

- ING - Has increased the minimum deposit needed for investment loans to 20%. They have also announced that interest rate discounts will no longer apply to variable or fixed new investment loans. These changes will only affect new ING investment loans, not existing.

- AMP - Will increase all existing variable investment mortgages by 0.47% from September 7th. In a more severe move, they are not accepting any new investor applications for residential mortgages. This is effective immediately and is not expected to change until 'later in 2015, depending on market conditions'. If you have made an application with AMP, which has not yet been approved, you should check that they have not refused to process it any further.

Why are Investment Loans Becoming More Expensive?

The Council of Financial Regulators wants to reduce the risk within the Australian mortgage sector. Reducing the growth of residential investment mortgages is one of the goals set out by APRA, who noted that areas of specific prudential concern include:

Higher risk mortgage lending - Which includes high loan to value ratio loans, interest only loans, and high loan to income mortgages.

Growth in investment mortgages - APRA wants to limit growth of investment mortgages to 10% per annum. A growth rate above 10% would increase the risk factor

Loan affordability tests - When banks assess how much new borrowers can afford, APRA wants them to use a minimum buffer of either 7% or 2% above the rate of the mortgage they are applying for. This means if you are applying for a new home loan with a rate of 4.5%, the bank will test your ability to make repayments at 7%

For now, the changes seem to be centered on investment loans, and while a lot of banks have made changes, not all of them have. In theory this should cause investors to take out home loans with banks who do not charge an investment premium or who still allow them to make a purchase with less than a 20% deposit.

Some investors may also decide to move their existing home loans to a lender who is offering better rates to investors. Our guess is that this is intentional. Banks who are worried about exceeding the 10% growth rate for residential investment mortgages, are trying to make themselves less competitive. AMP who has already grown by more than 10% this year, is no longer accepting new applications from residential investors.

Borrowing Will Become Harder for Everyone

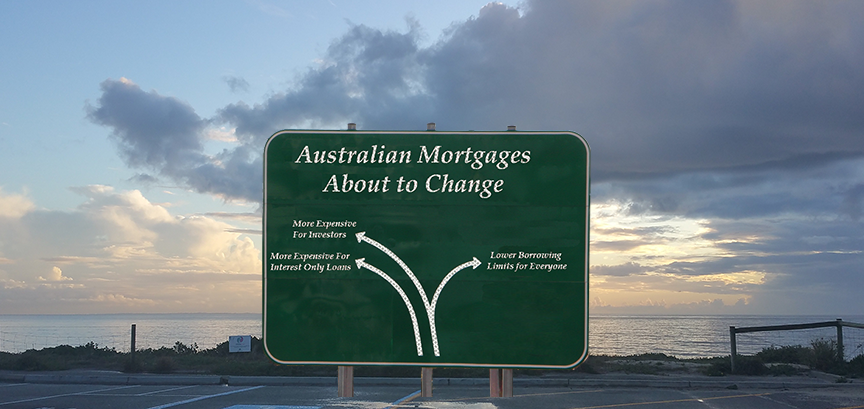

We think that the Australian mortgage industry will continue to go through a period of change. Unfortunately these changes will make it more difficult for us take out home loans. We don't have a crystal ball, but we expect that future changes could impact.

Interest Only Home Loans

NAB has already increased the rate they will charge to all interest only loans. We would not be surprised if other banks follow suit. Interest only loans are considered more risky, and we expect that they will soon be made less attractive when compared to principal and interest home loans.

Borrowing Limits

Minimum assessment rates will be set, but we are also expecting that the banks will adjust they way they calculate our lifestyle expenses. Currently most banks use the household expenditure method, which assumes that a married couple will incur expenses of $2,200 per month plus an extra $427 for each dependent child. We expect that this method will be adjusted to reflect that fact that people on higher incomes also have higher lifestyle expenses. These changes will reduce our borrowing limits for new home loans.

Negative Gearing

The Reserve Bank of Australia has stated that there is a 'case for reviewing negative gearing', but not in isolation. The generous tax concessions given to investors has been a polarizing topic. Investment related expenses, including interest on loans, should be deductible. However the regulators are worried that some people are buying properties with the sole goal of reducing their taxable income. Negative gearing is a polarizing issue, and any changes will be met with an abundance of opinions explaining why the changes are both right and wrong.

Only Time Will Tell

The extent and timing of future changes is unknown to us. The Council of Financial Regulators will continue to watch the market and make changes they feel will make Australian mortgages less risky. We can't say what the next change will be, but we will be watching with interest and will write about it after it happens.

We'd love to hear from your thoughts in the comment section below. What changes do you think will come? Will they help improve the Australian market?