China Slowing is Bad News For The Aussie Dollar

Today the Peoples Bank of China cut interest rates by 0.25% to 4.60%. It is the fifth time the bank has cut rates in the last year, as it tries to stimulate the slowing Chinese economy. The move follows a sharp drop on the Chinese stock market, which saw the Australian Dollar drop to a new 6 year low. China is Australia's biggest trading partner, and the Australian Economy will feel the impact of China slowing. This is why the Australian Dollar is falling and we expect it will continue to fall.

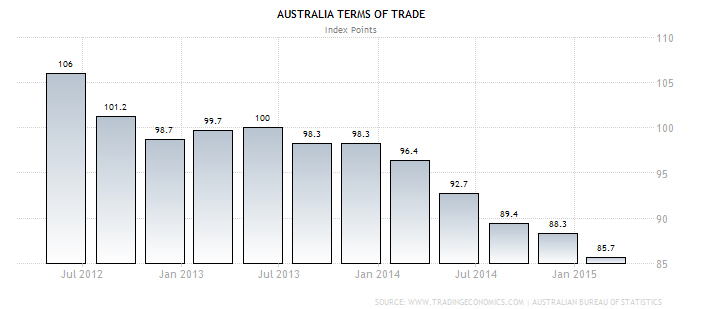

Australian Terms of Trade at Lowest Level Since 2006

Terms of trade is an international measure which looks at the value of exports and imports to an economy. If a country makes more on exports than it spends on imports, then it will have strong terms of trade. If terms of trade weaken, this means that the economy is spending more in imports than it is making on exports. On the foreign exchange market this means that more money is flowing out of the currency than into it. We mentioned terms of trade in our previous post as one of the reasons we expect the Australian Dollar to finish 2015 below US 70cents

Australian terms of trade have recently fallen to their lowest level since before the GFC in 2006. One of the main reasons is falling resource prices, as well as reduced demand from China for Australian exports. To put things in perspective, it is estimated that China represents over 57% of global demand for iron ore, and over 30% of global demand for copper ore. The Australian export price of Iron ore has fallen almost 25% in the past year. It is little wonder that Tourism has replaced Iron ore as our largest export.

Source: Trading Economics

As we can see from the chart above, Australian terms of trade have been steadily declining since 2012. We expect this terms of trade will fall further as China continues to slow, and Australia adjusts to life after the resources boom.

What Does This Mean for the Australian Dollar

The Australian Dollar has fallen more than 20% in the last year. We expect that the Aussie will drop below US 70 Cents in the near future, and we will continue to drift downward. While the price will fluctuate in the short term, we think that while terms of trade are weak, the Australian Dollar will continue to fall over the longer term.

Created with our AUD/USD Live chart

As we can see, the Australian dollar was trading at over US 90 cents less than one year ago. The foreign exchange rate of the Aussie Dollar has been drifting downward since September 2014, and is fast approaching the US 70 cent mark.

Can I Bet on the Australian Dollar Falling?

You can speculate on the price of Australian Dollar, by opening either a long or a short position on the currency. We have experimented with trading the AUD/USD through Plus500, and enjoyed some beginners luck, with our $200 deposit. We no longer play with real money but do use their demo account to simulate trading strategies.

If you do decide to invest in foreign exchange, then we suggest that you only put in as much as you are willing to lose. Leveraged investment is highly risky and small moves in the forex market can result in significant changes to your capital value. Make sure that you are willing to take on the financial risk before committing any of your own funds.

What are your thoughts? Where to you think the Aussie Dollar is headed, and what will get it there? We' love you hear your opinions in the comments section below.