Money Enters The Digital Age

The internet has been a revolutionary technology. It's changed the way we find information. It's changed the way we communicate with each other, and now it's changing the way we transfer money. Money has entered the digital age, it's never been cheaper or easier to send money to friends and family in other parts of the world.

We believe that a world leader in this development is M Pesa, and in particular, the success they have had in Kenya. We decided to have a streetonomic look at how M Pesa works, and also looked at other options for transferring money internationally to Kenya.

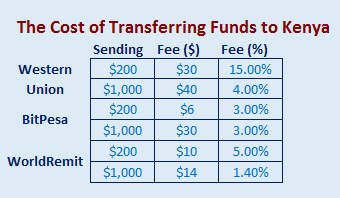

We looked at sending Western Union, WorldRemit, and Bitpesa. All three offer the ability to send money directly to M Pesa mobile wallets. The first thing we looked at was the cost of sending either $200 or $1,000 Australian Dollars with each provider. Our findings are shown in the table below:

PAll three essentially offer the same service, transferring funds directly to a mobile wallet, yet there is substantial difference in the prices charged. The cheapest way to send $200 is through Bitpesa, and the cheapest way to send $1,000 is through WorldRemit. The most expensive of the three is Western Union.

What is a M-Pesa Mobile Wallet?

Mobile wallets are a way to store money on your mobile phone. The most popular mobile wallet provider is M-Pesa, so we will use them for our streetonomic insight. M-Pesa started in 2007 and is available through Safricom, which is the local Vodafone provider. M-Pesa was named the Kenyan superbrand of the year for 2015.

M-Pesa turns your phone into a digital wallet. You can top up your credit the same way you buy air time, and can transfer funds directly from your M-Pesa mobile wallet, to another mobile wallet or bank account. M-Pesa has been successful with both individuals and merchants.

For small transactions, it's much cheaper than using a bank, and it's much safer and more convenient than using cash. Whether it's sending money to relatives in other parts of the country, or buying a cup of coffee, more and more Kenyans are choosing to use M Pesa to transfer their funds

M-Pesa has 19 million users in Kenya, and represents an estimated 43% of GDP. For the first half of 2014 USD $12 Billion worth of transactions were made using M-Pesa. They are also making an impact in other parts of the world. Some of the highlights from the statistics we found, are shown below:

- USD $820 Million worth of Transactions for first half of 2014 in Tanzania

- 7.6 Million users in South Africa

- 78,000 transactions per day in India

- Uber is working on integrating M-Pesa into their app

Working with fiat currency, means that M-Pesa has to satisfy the financial laws of each country. This includes rule around anti money laundering and client identification requirements. The benefit to the customers is that deposits held with M-Pesa have the same legal protection as banks.

If your recipient does not have an M-Pesa wallet, you can also arrange for funds to be sent as mobile airtime (on the Safricom network), as a bank transfer, or arrange for cash pick up

If you are sending less than $350, then BitPesa will be your cheapest option. They charge a flat fee of 3%, regardless of how much or how little you want to send. BitPesa cuts out international banks by using Bitcoin. This has enabled them to keep their prices low, but it also increases the financial risk of using them.

You can not send fiat currency with BitPesa, you can only send Bitcoin. If you don't already own Bitcoin, then you need to buy some. Buying Bitcoin is simple enough, you can do so at any exchange, but it does add an extra layer of fees. We looked at Bitstamp, who charge a fee of 0.5% to buy Bitcoin, so our cost of transferring is now 3.5%.

Sending a precise amount of Kenyan Schillings also becomes problematic. You have to first figure out how much Bitcoin you need, then pray that the value of Bitcoin doesn't fluctuate wildly before you complete the transfer. BitPesa themselves acknowledge this risk, and their website quotes:

the price or value of Bitcoin can change rapidly, decrease, and potentially even fall to zero. Upon your confirmation of an Exchange Transaction, during the Transaction Period, we will honor the Exchange Rate quoted for the Exchange Transaction. However, we are not responsible for, and you agree to hold us harmless against, fluctuations in the Exchange Rate while Bitcoin is in your BitPesa Account or while a transfer of Bitcoin to or from your BitPesa Account is pending

BitPesa is a great option for small transfers, specially if you don't mind taking on some exchange rate risk. It will be particularly appealing to people who are familiar with Bitcoin, and already hold the cryptocurrency.

If you live in an area where Bitcoin is restricted, then you will not have access to BitPesa

WorldRemit is available for senders in 50 countries, who can transfer funds to 110 destinations worldwide, so this service is in no way limited to Kenya.

If you are sending more than $350, then WorldRemit will be your cheapest option. On top of this, they offer guaranteed exchange rates, and the convenience and safety of being able to transact with normal fiat money. Dealing with fiat money rather than Bitcoin, may be more expensive for smaller transfers, but for the extra cost, you are removing the financial risk.

Accel Partners are strong believers in the future of WorldRemit, and have invested $40 Million in the company. Accel have a reputation for identifying quality online investments and were early investors in Facebook, Spotify, and Dropbox.

Established in 1851, Western Union has been offering money transfer services since 1871. They haven't just been doing this since before the internet, they were transferring funds 5 years before the telephone! In 1884, Western Union was one of the 11 stocks included in the original Dow Jones Industrial Average.

At the age of 164 the company is still a technological leader in the financial services industry. Western Union offers a wide array of services including pre paid cards. Western Union has over 500,000 locations around the world and more than 100,000 ATMs.

Western Union is the most expensive of the options we looked at. They are a full service option for those who want more than a simple transfer. They also have the advantage of being an established brand with a well recognized name. Consumers are more likely to trust the 164 year old Western Union, than a recent internet start up they have only just heard of.

We expect that Western Union will continue to be an innovative force in the money transfer industry and we look forward to seeing how their services continue to evolve. If there is a future for cryptocurrencies, we are sure Western Union will be a part of it. They might even have their own alt coin!

Our crystal ball couldn't tell us if the future will be mobile wallets, cryptocurrencies or some other technology, but it did tell us that the world is moving closer to a cashless society. We look forward to what the future holds, and will be here giving our streetonomic view every step of the way.