Is Negative Gearing Really a Benefit?

The Reserve Bank of Australia has released their September 2014 Financial Stability Review. The section on household and personal finances, was of particular interest to us. The RBA has noted that they are concerned about the growing level of interest only home loans in Australia.

The study found that of new loans approved, approximately 30% of owner occupiers and 60% of investors have selected interest only loans. The concern is that borrowers are taking on too much risk, specially at a time when interest rates are low, and expected to start rising in the future.

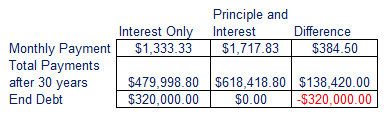

The average mortgage taken out in Australia was for $320,000 at a rate close to 5%. Borrowers tend to choose interest only because the payments are lower. It means more cash to spend today. Salespeople of all sorts, will promote interest only options based on saving more tax. They will also assure you that there is no need to pay more than interest only, because the value of the property will go up over time.

Based on the average home loan, the difference between interest only and principle and interest payments, is shown on the table below:

The difference in payments is $384.50 per month, or around $12.65 per day. While some will tell you that you need to 'keep your negative gearing', we disagree. Over the course of the loan, you will have paid in just under $135,000 in extra repayments, and in exchange will have an extra $320,000 of equity.

If you consider the extra payments as a monthly investment, that's a return of 5% (which is no surprise). The best part is that the returns are tax free. If you sold your property, you would not pay any more capital gains tax than someone who had been paying interest only for 30 years.

The difference is that you have gradually paid off your loan, while they have not, as shown in the graph below:

This graph was made using our compare payments calculator

A risk free, tax free return of 5% is a great investment. It's like having a savings account at a bank paying 7.14% (if your tax rate is 30%). I can hear all the salespeople screaming 'what about the negative gearing?'.

The interesting thing about negative gearing, is that it only works when you are losing money. It allows you to claim a tax deduction on the losses you incurred by paying interest on an investment loan. This means that your costs including interest exceed the rental you are earning on a property. Your income is reduced because your investment is losing money.

If your tax rate is 30% then for every $1 you lose in interest, you can claim back 30 cents on your annual tax return. This leaves you with a loss of 70 cents.

Conversely, if you have a property which is positively geared, this means that your rental returns are covering your expenses, and you are making an ongoing profit, which, you will pay tax on.

Assuming again a tax rate of 30%, for every dollar of income your property generates, you will pay 30 cents tax, leaving you with an overall gain of 70 cents.

If you had a property with $1,000 of negative gearing, you would lose $700, if the same property was positively geared and made $1,000, you would be up $700. This is shown in the table below:

If you have the additional funds, paying down the mortgage is a great idea. Paying interest only is the cheaper option now, but down the track, when you achieve positive or neutral gearing, your property will be paying for itself, and you will be accumulating equity.

If you are using negative gearing purely as a strategy to reduce your annual tax, then maybe consider working less. It would have the same effect.. it would reduce your income and in effect you would pay less tax.

What do you think? Would use a tax reduction strategy if all it did was reduce your income?