Does a lower interest rate always save you money?

If you are an Australian with an existing home loan, credit card, or any other debt, then now is a great time to review your loans. The lending market in Australia is currently extremely competitive, and there are plenty of banks out there willing to offer you a better deal if you move your existing loans to them.

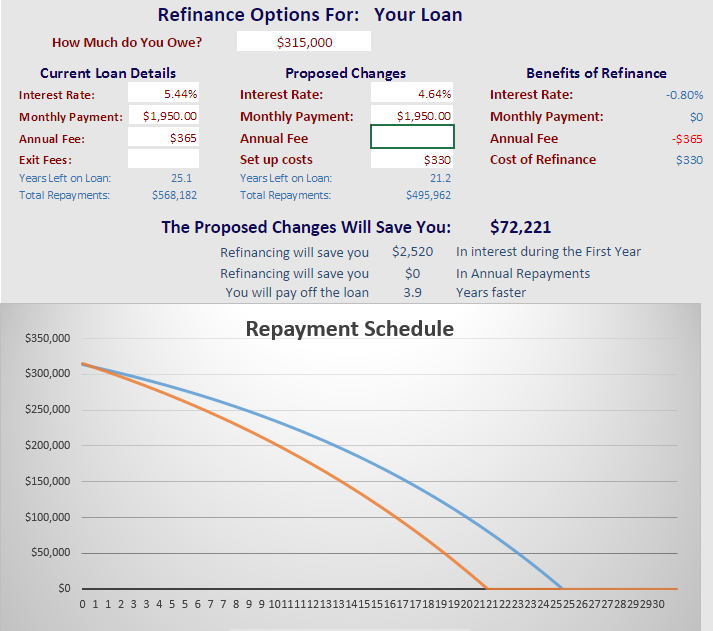

I recently spoke to a friend who has an existing home loan of $315,000. His current bank is charging him 5.44%. By shopping around, he discovered that because his loan to value ratio is below 70%, he can refinance and his interest rate would reduce to 4.64%.

He asked me to go over the details with him to ensure that he wasn't missing any catches. This is a substantial reduction in interest. Based on his current balance, he will save $2,520 per year or $210 per month, in interest charges. After looking over the details of both his current mortgage and this new offer, he decided that he will proceed with the refinance.

My friend decided that he would keep his repayment unchanged, so the saving in interest would be like making extra repayments. By doing this he will pay off his mortgage four years faster and save just over $72,000, which means his total repayments have reduced by around 13% This is shown below:

While my friend will save a lot of money and be mortgage free faster, not all refinance deals will save you money. If you are looking to refinance your home loan, you should consider all the costs and benefits such as:

Exit Fees - Depending on how your current mortgage is structured, you may have to pay significant fees before you leave your bank. This could mean that you are better off staying with your current bank for a little while longer

Reversion rates - Make sure you understand what your ongoing rate will be. The lowest rates on offer are often on either short term fixed loans (3 years or less), or on honeymoon variable deals (this means that they offer you a big discount but it's only for the first year or two). Somewhere in the small print, there will be a 'reversion rate'. This shows you what you will be paying once the discount or fixed period has expired. To avoid this, try and find banks who will offer you a competitive discount for the life of the loan. There is no guarantee that the deals you can get in 3 years will be competitive, so why settle for a discount that expires at that time?

Making the minimum payment - When you refinance your mortgage, in most cases, the bank will automatically offer you a new home loan at the maximum term of 30 years (unless you request a shorter term). The minimum payment on the mortgage documents is designed to pay the home loan off in 30 years, but you have the option to pay more than the minimum.

The loan documents my friend received from his new bank were for a term of 30 years. He could pay as little as $1,622 per month, rather than the $1,950 he has chosen to pay. If he decided to make only the minimum payment, he would have an extra $3,932 per year to spend on something other than mortgage repayments.

Reducing your payments by over $300 a month may sound tempting, but if my friend were to do this, he would extend his loan term from 25 years to 30 years. So while he is paying less every month, he is doing so for an extra 5 years. If he had done this, then the refinance would have cost him around $17,000, as shown below:

It is tempting to reduce your monthly payments and have more cash in your wallet today, but this could have a negative impact on your finances in the long term.

My friend kept his repayments unchanged. This means that he is using all of the savings he is making on interest to pay off his loan faster. Paying the minimum would cost him more over the long term, but there is always a middle ground. For some of us, reducing the monthly cash flows is very important.

If my friend chose to pay $1778, he would save $2,000 per year in mortgage payments, and would pay off his home loan in 25 years. This means he is debt free at the same time as he would be with his current bank, but has saved just under $35,000 in total repayments. He hasn't saved $72,000, but he has still made a good saving and has improved his monthly cash flows. as shown below:

May all your refinances save you money and get your home loans paid out faster. As always we love hearing from you, so please send us feedback